Sure, I love to drink wine. It’s a well-documented fact. And I love learning about it… at one time I even considered enrolling in Argentina’s main sommelier school. But besides appreciation, the business of wine is also of interest, especially due to the boom in production & export over the last decade. Often along with tasting notes, I also catalog prices. This is the first time I’ve graphed some of the data, & there are a few surprises.

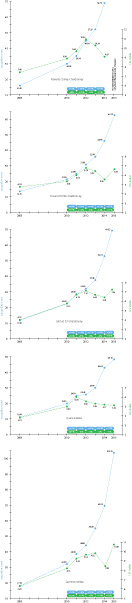

Wines chosen for the graph are standards… nothing fancy, no alta gama here. Just your basic everyday wines. There are three chardonnays (Navarro Correas, Finca El Portillo & Latitud 33º) plus two malbecs (Quara & Septima). Prices were obtained in Jul-Aug 2005, 2010 & 2011. US dollar exchange rates used to convert prices were $2.90, $3.93 & $4.13, respectively —an average of the official exchange rate during those months.

Interesting results: inflation from last year ranged between 14-28% in pesos for the wines selected. That gives everyone a good idea of what the economy is doing. Septima seems to be more popular these days (I see it popping up in new places all the time), so that could account for some of their price increase. But the most interesting graph of the bunch is from Latitud 33º… pegging the value of their wine to the dollar and to inflation. The winery is run by Chandon, & they appear to keep tight control on pricing. Fascinating to discover.

But wait, there’s more…

While wandering through the Coto wine aisles, it’s hard to ignore the shocking disparity between their wine prices & what is available at the local minimarket run by Chinese immigrants… my friendly neighborhood chino. Just a couple comparisons. Familia Gascón, a mid-range line produced by Bodegas Escorihuela, goes for 27 pesos at the chino but Coto charges 41 pesos. That’s 33% more. Estiba I by Bodegas Esmeralda is 20 pesos at the chino while it costs $26 at Coto, or 23% more. In other words, I can’t remember the last time I bought a bottle of wine at Coto. Not worth it.

For a look at what the wine market is doing overseas, a Chicago-based friend [Will it Waffle?] sent me the following prices in February of this year… good to have handy when you go wine shopping in BA. These are all for malbec:

2009 Malma U$S 12 · 2009 Nieto Senetiner U$S 9 · 2010 Alamos U$S 9 · 2005 Weinart U$S 20 · 2008 Catena U$S 18

Surprisingly enough, I can get Alamos at the chino for exactly the same price as in Chicago.

Although wine pricing is all over the map, there are some good indicators from this data. Official stats for inflation are manipulated by the government, but these numbers are slightly lower than figures reported by private analysts. A good guess for yearly inflation between 2010 & 2011 would be 25%. Thankfully, wine is a bit behind the national average. Export volume must be incredibly high to bring the price down to local levels… or Argentine customers are being gouged. And remember: the selection at your local minimarket may be limited, but the price is right. ¡Salud!

———————— 2012 ————————

12 Aug 2012: One year after the post above, inflation remains a taboo subject for the CFK administration. Yet it hasn’t gone away. With large numbers of bills being printed & released into the system, 20-25% inflation will likely be the norm over the next few years.

Wine prices are doing some interesting things. Some previously lower priced wines are catching up with more expensive ones… but not all. Quara even decreased in price! As the price/quality boundaries are increasingly blurred, restaurants have really upped their prices. It used to be fairly easy for visitors unfamiliar with wineries to pick out a decent bottle based on price. Doesn’t seem like that’s the norm these days. It will be interesting to see what happens next year…

———————— 2013 ————————

22 Aug 2013: It’s been another interesting year for the Argentina economy. Official talk of inflation remains taboo although everyone tries to find a means for coping with it.

Really interesting data this year too. Many thanks to Dan Perlman of Casa SaltShaker who scouted prices for me in Buenos Aires since I’m living in Patagonia now. Four of the five wines surveyed have dropped their price in USD by 4-6%. And their average increase in pesos was a standard 13-15%. I’ll leave interpretations to those better qualified than myself, but after so much disparity over the last few years it’s interesting to see a pattern now. Rumor has it that a devaluation may take place after elections in October, so that will certainly affect prices… if it happens. We’ll have to wait & see.

———————— 2014 ————————

13 Aug 2014: Well, would you look at that? All five wines have dropped in dollar value back to what they were in 2010. All of them. A friend of mine in the wine business says the lower prices must be due to producers not being able to sell as much. Whatever the reason, I never expected to see that trend when I started this yearly update. And almost as unbelievable is that in pesos, the same wines are twice as much… double the price of 2010. Even though I know prices for me personally have dropped (I earn dollars), sticker shock makes me cringe every time. You want how many pesos for that???

———————— 2015 ————————

16 Oct 2015: Yikes, I’m late! Considering I no longer live in Argentina, my focus is elsewhere these days. I found prices online with the major supermarkets chains Coto & Disco. Navarro Correas is either not making a standard chardonnay now (unlikely) or does not sell it to supermarkets (perhaps). Whatever the reason, I found no data online for this year’s update. Price levels seems to have recovered to 2012 levels for the most part. Septima has lost their mind by seriously increasing their price while Quara sits steady. In general I’d say that 2014 was the year to stock up on wine in Argentina. However there is no single, identifiable trend from these numbers. Let’s wait for next year when Argentina has a new President…

Nice. Reminds me I should make a trip to the wineshop for some more, uh, research.

Definitely. See? I finally got around to writing the post 🙂